“We are a Team with ETHOS”

The Group

Our Brands

Sustainability

Investor Relations

News & Media

Careers in Sarantis

-

Who we are

-

What we do

-

Our People

Our People-

Career opportunities

-

Sustainability

Sustainability -

Investor Relations

Investor Relations-

Financial Results

-

Our share

-

Investors' Information

-

Investor News & Updates

-

News & Media

News & Media

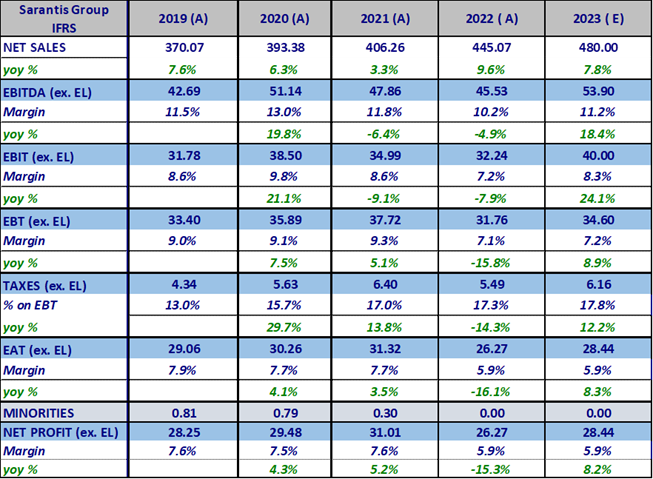

During its annual corporate presentation, Sarantis Group presented the FY 2022 financial results as well as the management’s strategy and estimates for 2023.

2022 was a successful year for the Group, as evidenced by its strong sales volume growth of 9.6%, amidst a highly complex business environment, characterized by record inflation, supply chain disruptions, energy crisis and challenges caused by the war in Ukraine. The Group generated a net cash position of €15.35 mil. and free cashflow, demonstrating its strong financial position.

Additionally, the Group implemented successfully a product rationalization process, which supported volume growth this year and strategically positions the Group for further future growth by focusing on its HERO portfolio, the Group’s high-value core products.

The Group’s total turnover during FY 2022 reached € 445.07 million from € 406.26 million in FY 2021, up by 9.55%, a significant performance driven by both value and volume.

The diversification of the Group’s product portfolio, its focus behind its HERO portfolio and its ability to exploit opportunities in high-potential spaces, as well as pricing actions, supported sales growth, across the Group’s region and behind its strategic product categories, particularly within the categories of skin care, sun care, body wash, deodorants, garbage bags, food packaging products and food supplements, as well as luxury cosmetics, that were positively influenced by higher demand.

Greek sales amounted to €148.24 million in 2022 compared to €142.78 mil. last year, up by 3.82%, presenting significant growth behind strategic personal care categories, such as skin care, suncare, deodorants, fragrances, haircare, as well as behind the home care categories of food packaging and garbage bags. At the same time, Greek sales benefited considerably from growth opportunities within the health care and the exports channels, while strong growth was observed in the luxury cosmetics channel.

The Affiliates exhibited significant sales growth of 12.66% across all strategic product categories, reaching €296.83 million in 2022 from €263.48 million last year. Excluding the fx currency impact, on a currency neutral basis, Affiliates’ sales presented a growth of 14.23%.

It is worth to mention that Affiliates’ sales include sales from the Group’s subsidiary in Ukraine, Ergopack. Following the initial suspension of its operation as a result of Russia’s invasion in Ukraine, Ergopack’s production facility, which is based in Kaniv, has been in full operation since the end of April of 2022.

Throughout 2022, persisting cost inflation, that was further exacerbated due to the war in Ukraine, put significant pressure on the Group’s profitability.

In order to partially mitigate the impact of inflationary pressures and supply chain disruptions the Group responded with initiatives aimed at driving top line growth, including dynamic pricing and enhanced diversification, while at the same safeguarding the Group’s competitive positioning and focus behind quality. In addition, the Group placed emphasis on cost saving initiatives, relating to supply chain optimization, product portfolio rationalization, focus on increasing efficiency and productivity, and balanced advertising and promotion expenses.

Overall, the Group is navigating a difficult market environment, but remains committed to its strategic agenda investing in initiatives to accelerate growth, either organically or through acquisitions, and to return value to its shareholders.

The management remains focused on sustaining the Group’s growth momentum and competitiveness while protecting its profitability margins. We will continuously review our action plan to activate further mitigating actions and deliver improved margins. At the same time, we expect that our strategic focus on our high value HERO portfolio will have a significant positive impact on our future growth prospects.

Our long-term strategy is centred around our strategic priorities of organic and acquisitive growth, market development and penetration, cost efficiencies, economies of scale, benefits from synergies, and operating leverage.

The Management’s guidance with regards to the Group’s 2023 financial performance is shown in the table below.

The Group’s presentation can be found in the Company’s website:

Presentations (sarantisgroup.com)

Issuance of Tax Certificate for the Fiscal Year 2024

Contact

SARANTIS Group

26, Amaroussiou - Halandriou Street

151 25 Maroussi, Athens, Greece

Tel: +30 210 6173000

Fax: +30 210 6197081

e-mail: group-info@sarantisgroup.com

Connect with us

We're always looking to connect with those who share an interest.Management of Sarantis Group encourages everyone to Speak Up and report any inappropriate behaviour or practice. SARANTIS Group Speak Up