Solid first half performance, in both sales and profitability, fuels confidence for continuing our sustainable growth momentum

Athens, Greece – September 11, 2023 – GR. Sarantis S.A. (SAR.AT, SAR:GA) announces its consolidated financial results for the six months period ended June 30th, 2023, prepared in accordance with International Financial Reporting Standards (IFRS).

Half year Highlights

- H1 2023 Net Sales grew to €232.35m vs €212.72m in H1 2022, higher by 9.23% on the back of the Group’s focused execution of its strategic priorities along with revenue growth management initiatives.

- H1 2023 EBITDA of €28.73m vs €22.57m in H1 2022, up by 27.26% reflecting increased revenue and improved margins. EBITDA margin of 12.36% (vs 10.61% in H1 2022).

- Earnings Before Interest and Tax (EBIT) at €21.58m in H1 2023, higher by 34.55% vs H1 2022 (H1 2022 EBIT: €16.04m) with EBIT margin at 9.29% in H1 2023 vs 7.54% in H1 2022. Comparable EBIT margin grew 175 basis points vs 2022 highlighting strong operating leverage from top-line growth.

- Earnings before Tax (EBT) at €23.47m in H1 2023 vs €14.69m in H1 2022, higher by 59.70%. EBT margin at 10.10% in H1 2023 (vs 6.91% in H1 2022).

- Net Profit in H1 2023 grew to €19.18m vs €11.53m in H1 2022, higher by 66.34% showcasing improved margins (H1 2023 Net Profit margin at 8.25% vs H1 2022 Net Profit margin at 5.42%).

- Strong EPS growth by 66.4%.

- Strong balance sheet and liquidity supported by the profitability of the business and the efficient working capital management; stable financial position with net cash of €5.17m.

- Dividend of €0.143108 per share paid in May (€10m or 38% payout ratio of 2022 Net profit).

- During the period the Group acquired the minority interest of 20% in Polipak for c.€5m (22m PLN) and repaid in full Polipak’s external debt of €20.5m.

- Implementation of the Group’s strategic growth agenda to drive business forward, based on three pillars: strong growth - consistent base business growth with acquisitions coming on top, simplification and efficiency so as to unlock value and release energy in the organization and organizational capability by skills upscaling and leadership development.

- Continued commitment to the rationalization of our portfolio focusing on HERO product portfolio, the Group’s high-value core brands across its strategic categories, which drive profitability and sustainable growth for the business.

Giannis Bouras, Deputy Chief Executive Officer of Sarantis Group, commented on the H1 2023 results:

“In H1 of fiscal year 2023 we achieved strong performance growing both top and bottom line. The Group exceeded in sales, earnings and cash generation delivering broad-based organic growth across all our business units and main categories: Beauty & Skin Care, Personal Care, Home Care Solutions and Strategic Partnerships.

Looking forward we have upgraded the outlook for the full 2023 fiscal year and are confident we will continue our sustainable growth momentum.

We are committed to our core strategies of delivering sustainable strong growth investing and innovating in our core categories, driving simplification and efficiency to create value and release energy in the organization, while building our people through skills and capability upscaling.

Overall, our people across our markets and the Group played a determinant role in achieving these results and I want to thank them all for their contribution.”

|

Income Statement Summary |

|||

|

Amounts in €m (unless otherwise stated) |

H1 2023 |

H1 2022 |

Δ% |

|

Net Sales |

232,35 |

212,72 |

9,23% |

|

Gross Profit |

86,23 |

74,86 |

15,19% |

|

Gross Profit Margin |

37,11% |

35,19% |

+192bps |

|

EBITDA |

28,73 |

22,57 |

27,26% |

|

EBITDA margin |

12,36% |

10,61% |

+175bps |

|

EBT |

23,47 |

14,69 |

59,70% |

|

EBT margin |

10,10% |

6,91% |

+319bps |

|

Taxes |

4,58 |

3,11 |

47,27% |

|

Profit After Tax |

18,88 |

11,58 |

63,08% |

|

Minorities |

-0,29 |

0,05 |

|

|

Net Profit |

19,18 |

11,53 |

66,34% |

|

Net Profit margin |

8,25% |

5,42% |

+283bps |

* The above numbers refer to continuing operations of the group, thus exclude discontinued activities in the comparable period relating to the sale of ELCA Cosmetics Ltd along with its subsidiaries and to the final withdrawal from the Russian market.

|

1. Business Outlook |

We delivered a solid first half performance, while the overall environment remains challenging. While we retain our attention to macroeconomic and geopolitical risks, we are confident that our strategy and execution will fuel sustainably our growth momentum. Thus, we significantly increase our profitability guidance for 2023.

- We expect net sales in line with previous guidance (unchanged at €480m, 7.8% vs 2022).

- We raise our guidance for organic EBIT growth. We now guide for €43m EBIT for 2023 (increase of 7.5% compared to our previous guidance of €40m), an increase of 33.37% compared to EBIT 2022 (€32.24m).

- With regards to EBIT margin, we now anticipate 8.9% for 2023, whilst before we had anticipated 8.3%, expecting it to grow by 60 basis points from previous guidance and 166 basis points from 2022 respectively.

|

2. Group operational review |

The Group’s total net sales during H1 2023 reached €232.35m from €212.72m in H1 2022, posting an increase by 9.23% vs H1 2022. The diversification of the Group’s product portfolio, the emphasis on the HERO product portfolio, its ability to capture growth opportunities, as well as the pricing initiatives strengthened the Group's sales across the entire geographic footprint and in our focus categories.

Compared to corresponding period of the previous year, a gradual normalization of the raw material prices and product transportation costs was observed during the first half of 2023, mitigating the impact on the Group's gross profit margin, while operating expenses along with advertising and promotion expenses were maintained under control reflecting a disciplined approach to operating expenditure. The Group exhibits a healthy financial position supported by the improving profitability of the business, and balanced capital expenditure.

As part of its strategy to further grow sales and profits organically, emphasis is given in optimizing and enhancing the Group’s product portfolio, leveraging the strong brand equity within its strategic product categories across its geographical region. Targeted investments and innovation plans are allocated behind strategic product development initiatives to drive further growth across our territory and generate value.

In the last three years, the Group focused on the HERO portfolio, its high-value core brands within our strategic categories that can drive profitability and sustainable growth. To this end a portfolio rationalization process was implemented, that resulted in the destruction of low value adding non-core stock, and generated benefits from the focus placed behind our HERO portfolio through increased sales and targeted advertising and promotional expenses. We expect that this strategic focus will have a significant positive impact on the future growth prospects of the Group.

Moreover, the Group is working to improve its operational efficiencies and effectiveness focusing on streamlining processes in the supply chain, investing in automations, infrastructure and systems. Our robust financial position enables us to consistently support our social and environmental ambitions, in line with our aim to maintain the optimum balance between our economic performance and our responsible environmental and social practices.

In May 2023, Sarantis Group paid dividends for the year 2022 of a gross amount of €10m (€0.143108 per share or 38% payout to 2022 net income).

During the period the Group acquired the minority interest of 20% in Polipak for c.€5m (22m PLN) and repaid in full Polipak’s external debt of €20.5m.

At the end of the first half of 2023, the Group successfully maintained a net positive cash position of €5.17m from €15.35 million at the end of 2022. The Group managed to improve its working capital needs in terms of sales compared to last year's levels, which demonstrates its ability to manage inventories effectively. Additionally, the Group's effective management of trade receivables showed its commitment to maintain a healthy cash flow position. Overall, the Group is navigating a challenging market environment, but remains committed to its strategic agenda investing in initiatives to accelerate growth, either organically or through acquisitions, and to return value to its shareholders.

Regarding the acquisition of STELLA PACK, a Polish consumer household products company, boasting 25 years of successful presence in the categories of Garbage Bags, Food Packaging and Cleaning items for the Household, this is expected to be finalized by the end of H2 2023, following the approval of the competition authorities, and it is estimated to create significant additional value to the Group, as well as contribute to the Group’s efforts behind circular economy practices.

|

3. Operational review by categories |

Net Sales by category

- Sales of Beauty and Skin Care products rose by 19.25% during H1 2023 at €32.36m, from €27.13m in the corresponding period of the previous year. The contribution of Beauty and Skin Care products to the Group's sales amounted to 13.93%.

- Sales of Personal Care products increased by 20.13% during H1 2023 at €43.38m from €36.11m in the corresponding period of the previous year. This upward trend reflects the diversification of product portfolio and the Group's ability to exploit growth opportunities. The contribution of Personal Care products to the Group's sales amounted to 18.67%.

- Sales of Home Care Solutions products amounted to €78.39m in H1 2023 from €73.30m in H1 2022, posting an increase of 6.95% vs H1 2022, reflecting the consumer trend in both the food packaging, as well as in waste bags which posted an increase in sales. The participation of Home Care Solutions products in the total sales of the Group amounted to 33.74%.

- The Private Label category represents sales of Polipak, the Polish packaging products company, which specializes on the production of garbage bags. It presented a sales increase of 4.48% to €15.93m in H1 2023 from €15.24m in H1 2022.

- The Strategic Partnerships category presented an increase in sales by 1.62% compared to the previous period, supported both by sales of Mass Market products that rose by 1.59%, as well as by sales of Selective Distribution products that posted an increase of 1.68%. Their participation in the total sales of the Group amounted to 25.99%.

- The Other Sales category presented an increase of 26.33% at €1.91m in H1 2023 from €1.51m in H1 2022.

|

Net Sales by category |

|||

|

Amounts in €m (unless otherwise stated) |

H1 2023 |

H1 2022 |

Δ% |

|

Beauty & Skin Care |

32.36 |

27.13 |

19.25% |

|

% of total sales |

13.93% |

12.76% |

|

|

Personal Care |

43.38 |

36.11 |

20.13% |

|

% of total sales |

18.67% |

16.98% |

|

|

Home Care Solutions |

78.39 |

73.30 |

6.95% |

|

% of total sales |

33.74% |

34.46% |

|

|

Private Label |

15.93 |

15.24% |

4.48% |

|

% of total sales |

6.85% |

7.17% |

|

|

Strategic Partnerships |

60.39 |

59.43 |

1.62% |

|

% of total sales |

25.99% |

27.94% |

|

|

Mass Distribution |

39.63 |

39.01 |

1.59% |

|

% of category |

65.63% |

65.65% |

|

|

Selective Distribution |

20.76 |

20.41 |

1.68% |

|

% of category |

34.37% |

34.35% |

|

|

Other Sales |

1.91 |

1.51 |

26.33% |

|

% of total sales |

0.82% |

0.71% |

|

|

TOTAL SALES |

232.35 |

212.72 |

9.23% |

Operating Profit by category

- EBIT of Beauty and Skin Care category amounted to €4.06m from €4.83m, posting a decrease of 15.92% vs H1 2022, mainly affected by the investment for the launching of the clean beauty brand Clinéa. The EBIT margin of Beauty and Skin Care category came at 12.56% in H1 2023 from 17.81% in the corresponding period of last year, again affected by Clinea launch.

- EBIT of Personal Care category products amounted to €5.82m from €3.22m, up by 80.88%, was positively affected by cost improvements impacting the gross profit margin and the balanced management of advertising and promotion expenses. The EBIT margin of Personal Care products rose to 13.42% in H1 2023 from 8.91% in H1 2022.

- EBIT of Home Care Solutions, rose to €9.26m from €5.55m. The EBIT margin of Home Care Solutions settled at 11.82% in H1 2023 from 7.58% in H1 2022.

- EBIT of Strategic Partnerships category presented a slight increase of 3.74% at €2.69m in H1 2023 compared to the corresponding period last year, while the EBIT margin reached 4.45% compared to 4.36% in H1 2022.

|

EBIT by category |

|||

|

Amounts in €m (unless otherwise stated) |

H1 2023 |

H1 2022* |

Δ% |

|

Beauty & Skin Care |

4.06 |

4.83 |

-15.92% |

|

EBIT margin |

12.56% |

17.81% |

-525bps |

|

Personal Care |

5.82 |

3.22% |

80.88% |

|

EBIT margin |

13.42% |

8.91% |

+451bps |

|

Home Care Solutions |

9.26 |

5.55 |

66.79% |

|

EBIT margin |

11.82% |

7.58% |

+424bps |

|

Private Label |

0.26 |

-0.04 |

781.17% |

|

EBIT margin |

1.62% |

-0.25% |

+187bps |

|

Strategic Partnerships |

2.69 |

2.59 |

3.74% |

|

EBIT margin |

4.45% |

4.36% |

+9bps |

|

Mass Distribution |

2.71 |

2.64 |

2.66% |

|

EBIT margin |

6.83% |

6.76% |

+7bps |

|

Selective Distribution |

-0.02 |

-0.05 |

58.98% |

|

EBIT margin |

-0.09% |

-0.22% |

|

|

Other Sales |

-0.52 |

-0.12 |

|

|

EBIT margin |

-27.05% |

-8.03% |

|

|

TOTAL EBIT |

21.58 |

16.04 |

34.55% |

|

Margin |

9.29% |

7.54% |

+175bps |

* Items in the comparable period of the 1st half of 2022 correspond to the Group's continuing operations excluding the contribution of ELCA Cosmetics Ltd, as the Group's participation was sold on June 15, 2022, and excluding the contribution of the Group's subsidiary Hoztorg LLC, as the company decided to permanently withdraw from the Russian market.

** For the period to June 30th 2023, the Group monitors the operating results in the above business units. Subsequently, last year's items have been adjusted in order to be comparable.

|

4. Operational review by our geographies |

Net Sales by geography

In terms of geographical analysis, sales in Greece (including Portugal) amounted to €74.98m in H1 2023 from €77.18m in H1 2022, marginally decreased by 2.85% on the back of the termination of the partnership with Coty-Wella concerning the mass distribution of the latter’s cosmetics In H1 2022.

Net sales in the international network, which represent 67.73% of the Group's total sales, increased by 16.10% to €157.37m in H1 2023 from €135.55m in H1 2022. Excluding the currency effect, on a currency neutral basis, sales of the international network increased by 17.75%.

All Group's countries benefited from the broad portfolio of Personal Care products and capitalized on growth opportunities, resulting in significant sales growth particularly in Beauty & Skin Care and Personal Care categories. In addition, the categories of waste bags and food packaging showed an increase in sales across all countries within the Group.

|

Net Sales by geography |

|||

|

Amounts in €m (unless otherwise stated) |

H1 2023 |

H1 2022 |

Δ% |

|

Greece (incl. Portugal) |

74.98 |

77.18 |

-2.85% |

|

% of sales |

32.27% |

36.28% |

|

|

Poland |

55.52 |

52.51 |

5.73% |

|

Romania |

37.2 |

31.88 |

16.67% |

|

Bulgaria |

9.05 |

7.05 |

28.40% |

|

West Balkans** |

17.66 |

14.16 |

24.69% |

|

Czech & Slovakia |

19.55 |

14.61 |

33.83% |

|

Ukraine |

12,00 |

9.72 |

23.51% |

|

Hungary |

6.4 |

5.62 |

13.87% |

|

International Network |

157.37 |

135.55 |

16.10% |

|

% of sales |

67.73% |

63.72% |

|

|

TOTAL SALES |

232.35 |

212.72 |

9.23% |

* Items in the comparable period of the 1st half of 2022 correspond to the Group's continuing operations excluding the contribution of ELCA Cosmetics Ltd, as the Group's participation was sold on June 15, 2022, and excluding the contribution of the Group's subsidiary Hoztorg LLC, as the company decided to permanently withdraw from the Russian market.

** The geographic area of Western Balkans includes sales in Serbia, Bosnia-Herzegovina, North Macedonia and Slovenia.

Operating Profit by geography

Regarding the operating profit by geographic region, during the first half of 2023 the EBIT of Greece (including Portugal) dropped by 20.23% to €7.04m from €8.83m in the corresponding period of the previous year, affected by the investment realized for the launching of the clean beauty brand Clinéa included in the Beauty and Skin Care category. The EBIT margin of Greece (including Portugal) stood at 9.39% in H1 2023 from 11.44% in H1 2022.

The countries of the international network presented an increase in EBIT of 101.67% to €14.53m from €7.21m in H1 2022 attributed to the categories of Beauty & Skin Care, Personal Care, as well as Home Care Solutions. The countries' EBIT margin stood at 9.24% from 5.32% in H1 2022.

|

EBIT by geography |

|||

|

Amounts in €m (unless otherwise stated) |

H1 2023 |

H1 2022 |

Δ% |

|

Greece (incl. Portugal) |

7.04 |

8.83 |

-20.23% |

|

EBIT margin |

9.39% |

11.44% |

-205bps |

|

Poland |

3.21 |

1.57 |

104.96% |

|

EBIT margin |

5.79% |

2.98% |

+280bps |

|

Romania |

5.53 |

3.67 |

50.74% |

|

EBIT margin |

14.86% |

11.50% |

+336bps |

|

Bulgaria |

0.93 |

0.45 |

103.86% |

|

EBIT margin |

10.23% |

6.44% |

+379bps |

|

West Balkans |

1.42 |

0.71 |

101.63% |

|

EBIT margin |

8.07% |

4.99% |

+308bps |

|

Czech & Slovakia |

2.18 |

1.37 |

59.18% |

|

EBIT margin |

11.16% |

9.38% |

+178bps |

|

Ukraine |

0.75 |

-0.15 |

611.77% |

|

EBIT margin |

6.22% |

-1.50% |

+772bps |

|

Hungary |

0.52 |

-0.41 |

224.59% |

|

EBIT margin |

8.05% |

-7.36% |

+1,541bps |

|

TOTAL EBIT |

21.58 |

16.04 |

34.55% |

|

EBIT Margin |

9.29% |

7.54% |

+175bps |

* Items in the comparable period of the 1st half of 2022 correspond to the Group's continuing operations excluding the contribution of ELCA Cosmetics Ltd, as the Group's participation was sold on June 15, 2022, and excluding the contribution of the Group's subsidiary Hoztorg LLC, as the company decided to permanently withdraw from the Russian market.

** The geographic area of Western Balkans includes sales in Serbia, Bosnia-Herzegovina, North Macedonia and Slovenia.

|

Disclaimer |

This document contains certain “forward-looking” statements. These statements are based on management’s current expectations and are naturally subject to uncertainty and changes in circumstances, which could affect materially the expected results, because current expectations and assumptions as to future events and circumstances may not prove accurate. Our actual results and events could differ materially from those anticipated in the forward-looking statements for many reasons, including the risks described in the 2022 Annual Financial Report of GR. Sarantis S.A. and its subsidiaries. This document serves only informative purposes and does not form or can either be referred to as a buy, sell or hold encouragement for shares or any other fixed income instruments. Investors must decide upon their investment actions based on their own investing preferences, financial status and advice from those registered investment advisors who consider appropriate.

|

Conference Call Invitation |

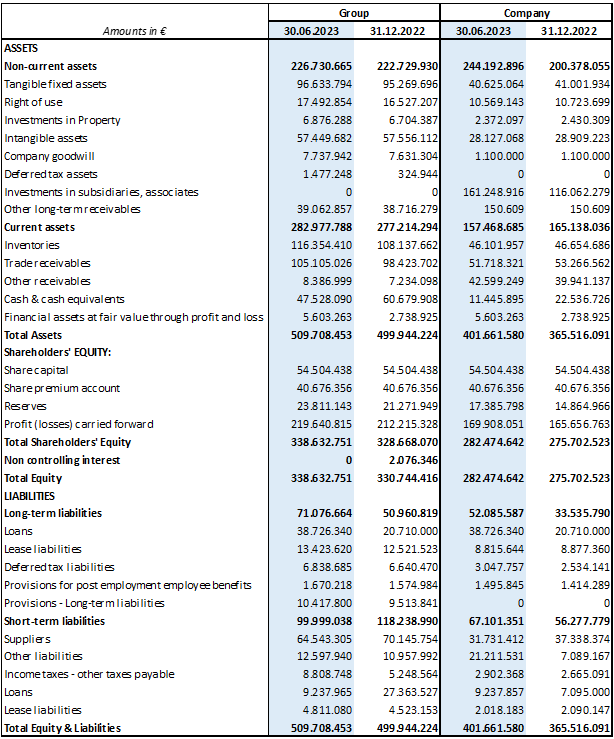

Statement of Financial Position

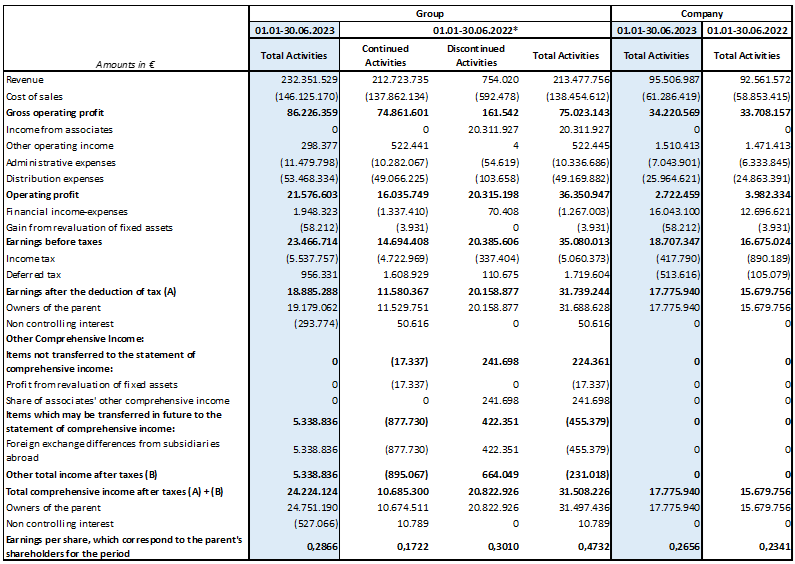

Interim Condensed items of Income Statement

* The Discontinued Activities in the comparable period refer to the sale of ELCA Cosmetics Ltd along with its subsidiaries and to the final withdrawal from the Russian market, in which the Company activated through its 100% indirect subsidiary, i.e. the commercial company HOZTORG LLC (see note 4.10.2 of the Group's financial statements as of December 31st, 2022).

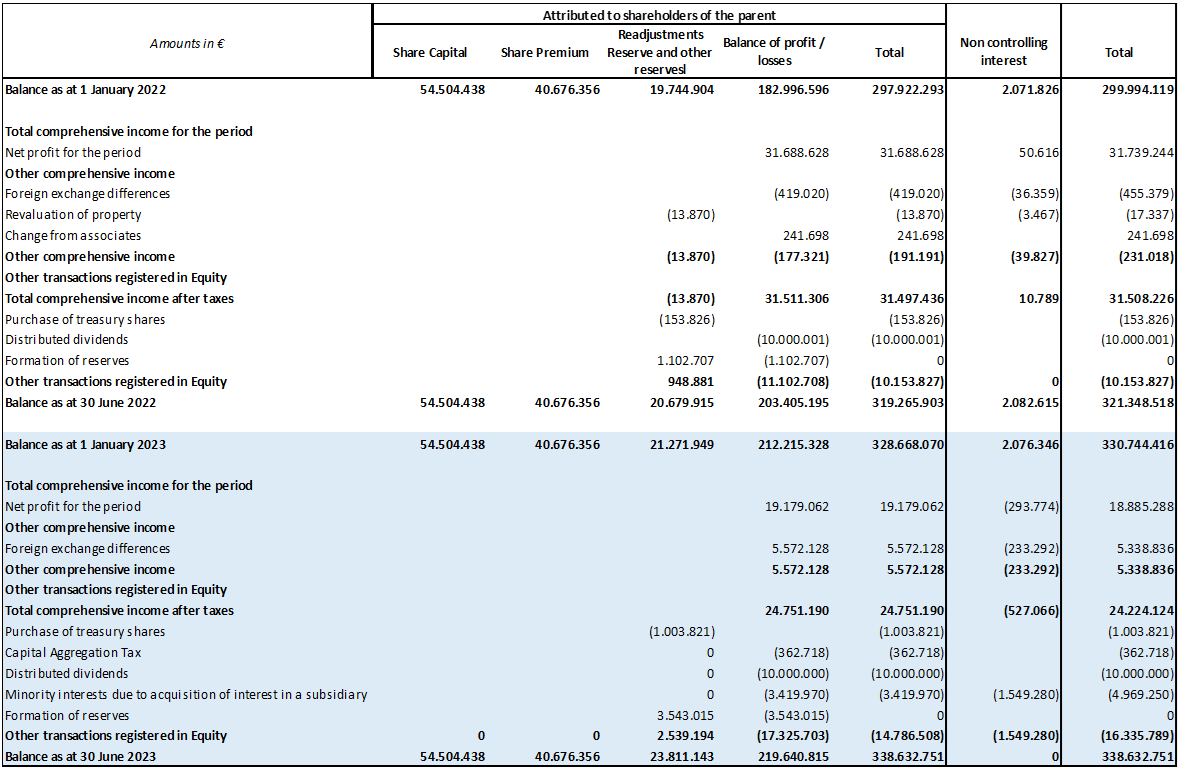

Interim Condensed Statement of Changes in Group’s equity

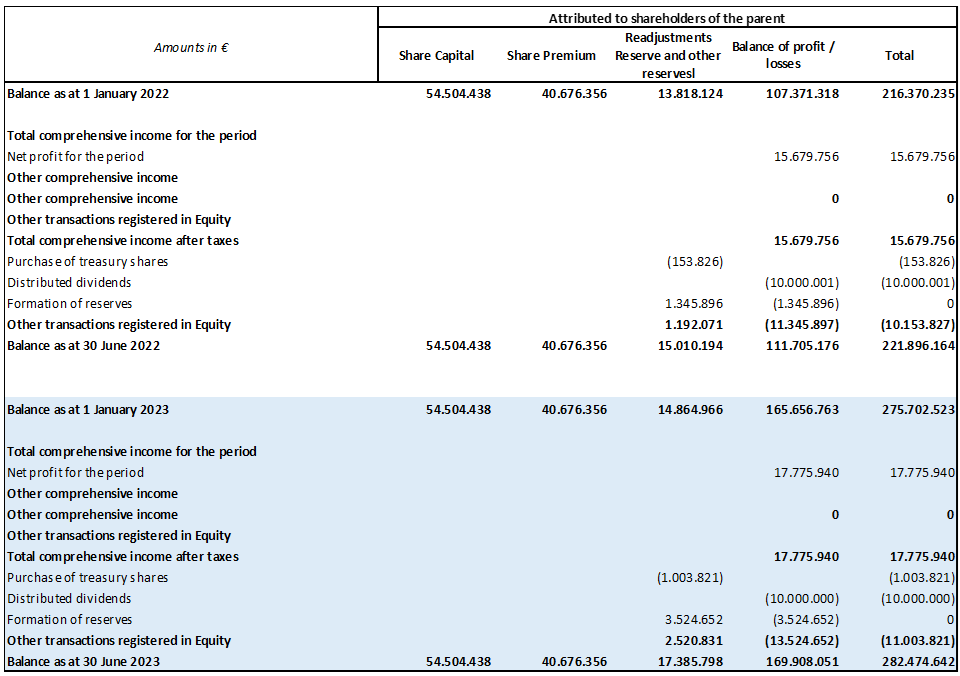

Interim Condensed Statement of changes in company’s equity

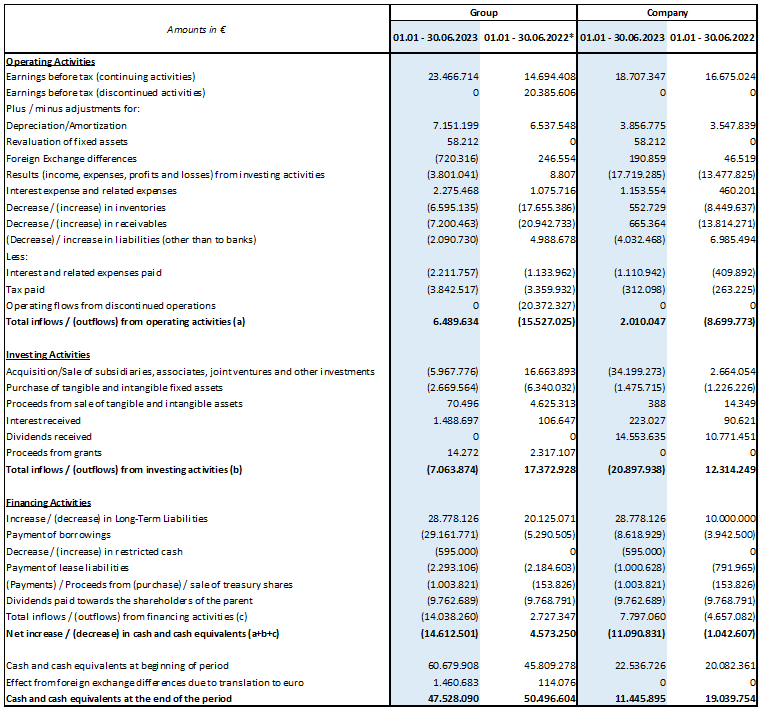

Interim consolidated statement of cash flows

* The Discontinued Activities in the comparable period refer to the sale of ELCA Cosmetics Ltd along with its subsidiaries and to the final withdrawal from the Russian market, in which the Company activated through its 100% indirect subsidiary, i.e. the commercial company HOZTORG LLC (see note 4.10.2 of the Group's financial statements as of December 31st, 2022).